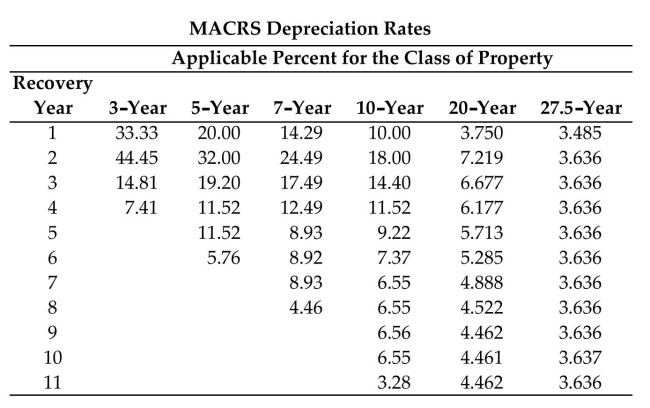

Find the first year's depreciation using the MACRS method of depreciation and the MACRS depreciation rates table. Round to the nearest dollar.

-Cost: $9,040

Period: 3-year

A) $1,339

B) $3,013

C) $1,808

D) $1,736

Correct Answer:

Verified

Q72: Find the first year's depreciation using the

Q73: Find the depreciation per unit. Round to

Q74: Use the sum-of-the-years'-digits method of depreciation. Round

Q75: Find the book value using the MACRS

Q76: Find the book value using the MACRS

Q78: Find the first year's depreciation using the

Q79: Use the MACRS depreciation rates table to

Q80: Solve the problem. Round to the nearest

Q81: Use the MACRS depreciation rates table to

Q82: Find the annual amount of depreciation using

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents