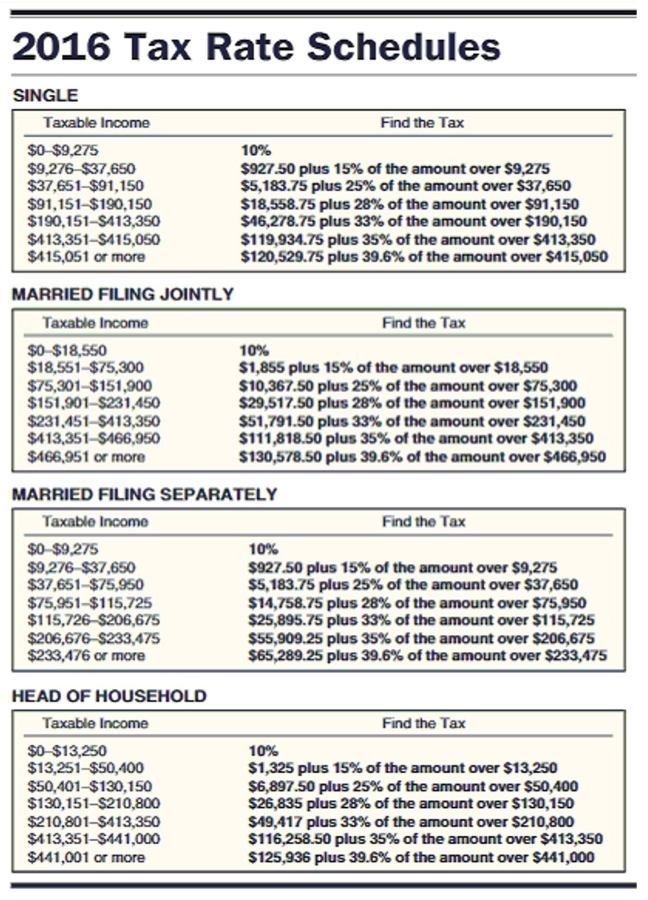

Find the tax in the following application problems. Use $4050 for each personal deduction, a standard deduction of $6300 for single taxpayers, $12,600 for married taxpayers filing jointly, $6300 for married taxpayers filing separately, and $9300 for head of household and the tax rate schedule.

-Mark Collins had an adjusted gross income of $26,741 last year. He had deductions of $899 for state income tax, $555 for property tax, $2,824 in mortgage interest, and $221 in contributions. Collins claims one exemption and files as a single person.

A) $1,311.15

B) $1,994.90

C) $3,631.30

D) $2,356.30

Correct Answer:

Verified

Q53: Find the amount paid by each of

Q54: Find the total annual premium. Use the

Q55: Find the tax in the following application

Q56: Find the amount paid by each insurance

Q57: Find the tax refund or tax due

Q59: Solve the problem.

-A driver injures a bicycle

Q60: Find the property tax. Round to

-Assessed Tax

Q61: Find the total annual premium. Use the

Q62: Find the indicated premium. Round to the

Q63: Find the adjusted gross income.

-Nancy earned $18,575

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents