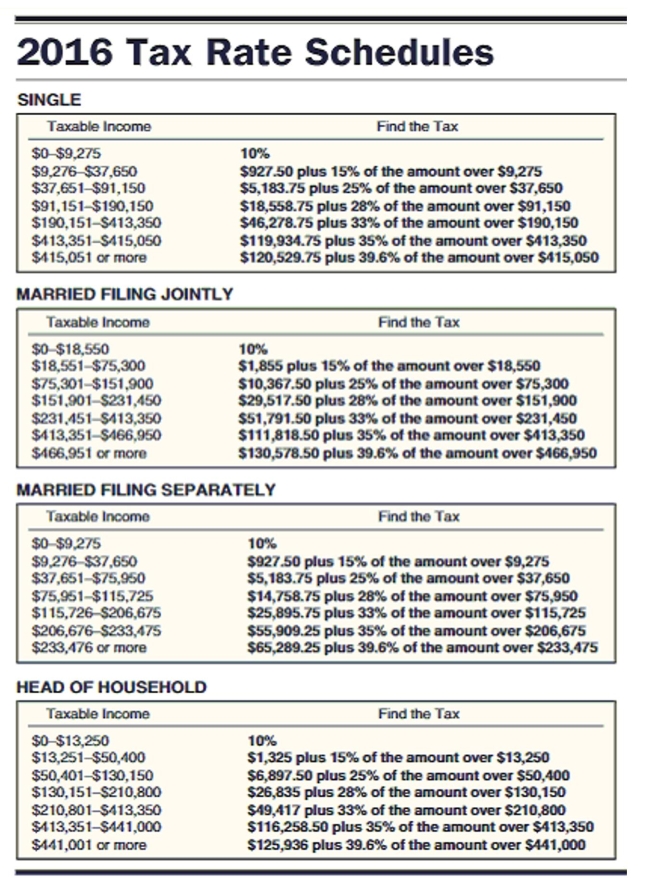

Find the amount of taxable income and the tax owed for the following people. The letter following the name indicates the marital status and all married people are filing jointly. Use $4050 for each personal exemption; $6300 as the standard deduction for single taxpayers, $12,600 for married taxpayers filing jointly, and $9300 for head of household and the following tax rate schedule.

-

A) $82,534; $9,849.00

B) $81,296; $11,866.50

C) $83,234; $13,485.52

D) $81,296; $13,138.88

Correct Answer:

Verified

Q76: Find the total annual premium. Use the

Q77: Find the amount of taxable income and

Q78: Find the amount paid by each of

Q79: Find the adjusted gross income.

-Curt had income

Q80: Find the tax in the following application

Q82: Find the tax in the following application

Q83: Find the amount to be paid by

Q84: Solve the problem. Use the fire insurance

Q85: Find the tax refund or tax due

Q86: Find the annual insurance premium.

-A person's youthful-operator

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents