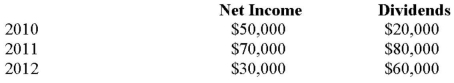

On January 1, 2010, X Inc. purchased 25% of the voting shares of Y Inc. for $100,000. The investment is reported using the equity method, as X has significant influence over Y. Y's net income and declared dividends for the following three years are as follows:  What would be the carrying value of X's Investment in Y at the end of 2012?

What would be the carrying value of X's Investment in Y at the end of 2012?

A) $100,000

B) $97,500

C) $98,800

D) $91,200

Bloom's

Correct Answer:

Verified

Q2: Gains and losses on fair-value-through-profit-or-loss securities:

A) are

Q3: What percentage of ownership is used as

Q4: Which of the following is NOT a

Q5: Which of the following methods uses procedures

Q6: When an investment is accounted for using

Q8: Reporting in accordance with the Accounting Standards

Q9: When are gains on intercompany transfers of

Q10: Which of the following statements pertaining to

Q11: Under which of the following scenarios would

Q12: Which of the following statements is TRUE

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents