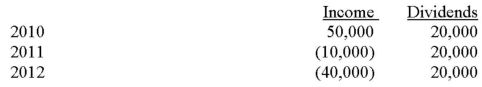

Dragon Corporation acquired a 7% interest in the outstanding shares of Slayer Inc. on January 1, 2010 at a cost of $200,000. Dragon Corporation was a private company and reported in compliance with the Accounting Standards for Private Enterprises and accounted for Slayer Inc., whose shares were not publicly traded, using the cost method. Slayer reported net income and made dividend payments to its shareholders at noted below. On December 31, 2012 Slayer declared bankruptcy as a result of a series of losses as noted.  a) Prepare the journal entries that Dragon would make in each year. b) Prepare the general ledger account for Dragon's investment in Slayer.

a) Prepare the journal entries that Dragon would make in each year. b) Prepare the general ledger account for Dragon's investment in Slayer.

Correct Answer:

Verified

Q22: Under which standards is it appropriate to

Q23: How does the accounting for Other Comprehensive

Q24: On January 1, 2009, Black Corporation purchased

Q25: If an investor is reporting in compliance

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents