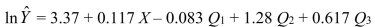

SCENARIO 16-14 A contractor developed a multiplicative time-series model to forecast the number of contracts in future quarters, using quarterly data on number of contracts during the 3-year period from 2011 to 2013.The following is the resulting regression equation:  where

where  is the estimated number of contracts in a quarter. X is the coded quarterly value with X = 0 in the first quarter of 2011.

is the estimated number of contracts in a quarter. X is the coded quarterly value with X = 0 in the first quarter of 2011.  is a dummy variable equal to 1 in the first quarter of a year and 0 otherwise. Q

is a dummy variable equal to 1 in the first quarter of a year and 0 otherwise. Q  is a dummy variable equal to 1 in the second quarter of a year and 0 otherwise.

is a dummy variable equal to 1 in the second quarter of a year and 0 otherwise.  is a dummy variable equal to 1 in the third quarter of a year and 0 otherwise.

is a dummy variable equal to 1 in the third quarter of a year and 0 otherwise.

-Referring to Scenario 16-14, in testing the coefficient of X in the regression equation (0.117) the results were a t-statistic of 9.08 and an associated p-value of 0.0000.Which of the following is the best interpretation of this result?

A) The quarterly growth rate in the number of contracts is significantly different from 0% (  = 0.05) .

= 0.05) .

B) The quarterly growth rate in the number of contracts is not significantly different from 0% (  = 0.05) .

= 0.05) .

C) The quarterly growth rate in the number of contracts is significantly different from 100% (  = 0.05) .

= 0.05) .

D) The quarterly growth rate in the number of contracts is not significantly different from 100% (  = 0.05) .

= 0.05) .

Correct Answer:

Verified

Q157: SCENARIO 16-13

Given below is the monthly time

Q159: SCENARIO 16-13 Given below is the monthly

Q160: SCENARIO 16-13 Given below is the monthly

Q161: SCENARIO 16-14 A contractor developed a multiplicative

Q162: SCENARIO 16-14 A contractor developed a multiplicative

Q163: With a 15 year time duration and

Q166: SCENARIO 16-14 A contractor developed a multiplicative

Q167: SCENARIO 16-14 A contractor developed a multiplicative

Q168: SCENARIO 16-14

A contractor developed a multiplicative time-series

Q168: SCENARIO 16-14 A contractor developed a multiplicative

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents