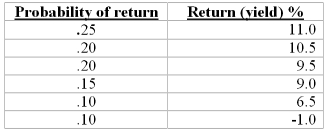

An individual faces two alternatives for an investment: Asset A has the following probability return schedule:

Asset B has a certain return of 8.0%. If the individual selects asset A does she violate the principle of risk aversion? Explain.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q70: Hedging risk and spreading risk are two

Q71: The Russian wheat crop fails, driving up

Q72: The variance of a portfolio containing n

Q73: If an investment offered an expected payoff

Q74: Spreading risk involves:

A) finding assets whose returns

Q76: The main reason for diversification for an

Q77: An automobile insurance company on average charges

Q78: In investment matters, generally young workers compared

Q79: The fact that not everyone places all

Q80: A portfolio of assets has lower risk

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents