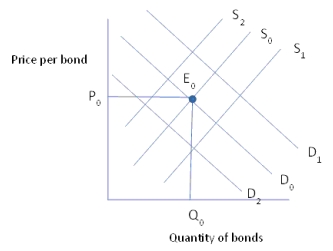

The market for bonds is initially described by the supply of bonds - S₀, and the demand for bonds - D₀, with the equilibrium price and quantity being P₀ and Q₀. If the federal government were to offer larger tax breaks on the purchase of new equipment for businesses, all other factors constant, we would expect to see:

A) Bond supply curve to shift to S₁

B) Bond demand curve to shift to D₁

C) Bond supply curve to shift to S₂

D) Bond demand curve to shift to D₂

Correct Answer:

Verified

Q80: If the federal government were to offer

Q81: Which of the following is true of

Q82: Consider a zero-coupon bond with a $1,100

Q83: Which of the following statements about the

Q84: Consider the bonds below. Which is subject

Q86: The U.S. Treasury issues bonds where the

Q87: A student receives a five-year loan to

Q88: Default risk is the risk associated with:

A)

Q89: Fly-By-Night Inc. issues $100 face value, zero-coupon,

Q90: The impact of a decrease in expected

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents