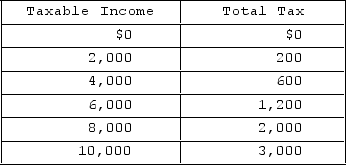

Refer to the personal income tax schedule given in the table. If your taxable income is $4,000, your average tax rate is

Refer to the personal income tax schedule given in the table. If your taxable income is $4,000, your average tax rate is

A) 15 percent; your marginal rate on the last $2,000 is 15 percent.

B) 15 percent; your marginal rate on the last $2,000 is 20 percent.

C) 15 percent; your marginal rate on the last $2,000 cannot be determined from the information given.

D) 20 percent; your marginal rate on the last $2,000 is 15 percent.

Correct Answer:

Verified

Q41: The state and local tax structure is

Q42: Assume that in year 1 you pay

Q43: Assume that in year 1 your average

Q44: If the supply of a product is

Q45: If the demand for a product is

Q47: In the U.S., the taxes mostly come

Q48: The overall tax structure of the United

Q49: If you would have to pay $5,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents