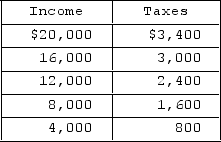

The table describes the relationship between income and a tax. The tax may be best described as

The table describes the relationship between income and a tax. The tax may be best described as

A) regressive at lower income levels and progressive at higher income levels.

B) regressive at lower income levels and proportional at higher income levels.

C) proportional at lower income levels and regressive at higher income levels.

D) proportional at lower income levels and progressive at higher income levels.

Correct Answer:

Verified

Q264: Tax incidence may be defined as the

A)average

Q265: The federal personal income tax

A)has a regressive

Q266: The incidence of taxation refers to

A)who in

Q267: If the tax on gasoline is increased,

Q268: The Social Security tax is regressive because

A)the

Q270: The burden of a specific sales tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents