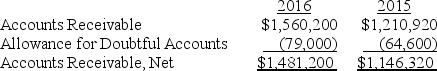

Assume the Murtha Company reported the following adjusted account balances at year-end.

Assume the company recorded no write-offs or recoveries during 2016.What was the amount of Bad Debt Expense reported in 2016?

A) $79,000

B) $64,600

C) $28,800

D) $14,400

Correct Answer:

Verified

Q41: Accounts Receivable,Net (or Net Accounts Receivable)equals Accounts

Q44: Failing to record bad debt expense in

Q46: Recording the estimate of bad debt expense:

A)increases

Q51: The adjusting entry used to record the

Q57: The challenge businesses face when estimating the

Q59: An objective of the expense recognition principle

Q61: Accounts Receivable has a $2,300 balance,and the

Q62: Cary Inc.reported net credit sales of $300,000

Q63: Plasma Inc.uses the percentage of credit sales

Q64: Labrador Inc.has the following information available for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents