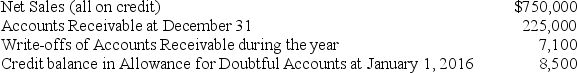

At December 31,2016,a company's records include the following:

Required:

Part a.The company estimates bad debts as 1.3% of credit sales.Prepare the required adjusting entry to record Bad Debt Expense for the year.

Part b.Assume instead that the company uses the aging of receivables method.Its aging analysis reveals that the estimate of uncollectible receivables is $11,250.Prepare the required adjusting entry to record Bad Debt Expense for the year.

Part c.Assume instead that the company estimates that its Bad Debt Expense for the year is $8,250.Use a T-account to determine the adjusted balance in the Allowance for Doubtful Accounts.

Correct Answer:

Verified

The percentage of credit sales me...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q192: A high receivables turnover ratio is a

Q201: When the direct write-off method is used

Q201: The Corning Company uses the percent of

Q202: A company uses the direct write-off method.The

Q202: A company that uses the allowance method

Q206: Samberg Inc.had the following transactions.

Oct.1 - Sold

Q208: The direct write-off method for uncollectible accounts

Q209: The following summarizes the aging of accounts

Q210: Cairo Co.uses the allowance method of accounting

Q219: When the direct write-off method is used,the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents