The Dubious Company operates in an industry where all sales are made on account.The company has experienced bad debt losses of 1% of credit sales in prior periods.

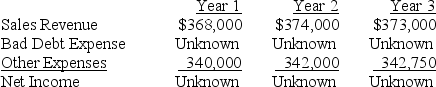

Presented below is the company's forecast of sales and expenses over the next three years.

Required:

Part a.Calculate Bad Debt Expense and net income for each of the three years,assuming uncollectible accounts are estimated as 1.0% of sales.

Part b.Briefly describe the trend in net income changes from Year 1 to Year 2 and from Year 2 to Year 3.

Part c.Assume that the company changes its estimate of uncollectible credit sales to 1.0% in Year 1,2.0% in Year 2 and 1.5% in Year 3.Calculate the Bad Debt Expense and net income for each of the three years under this alternative scenario.

Part d.Briefly describe the trend in net income changes determined in requirement c from Year 1 to Year 2 and Year 2 to Year 3.

Part e.Explain some of the factors that might cause the estimate of uncollectible accounts to vary from year to year (as in the assumption set forth in part c above).

Correct Answer:

Verified

Part b

Net income increased fr...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q213: Why is the direct write-off method not

Q220: Starseekers,Inc.began the year with a $4,800 normal

Q220: Santiago Cleaners allows customers make purchases using

Q221: Indicate whether each of the following items

Q222: Match the term and its definition.There are

Q224: Welles Company uses the direct write-off method

Q225: Consider each of the following transactions.

Required:

Indicate how

Q226: Match the term and its definition.There are

Q227: Consider the scenarios listed in the table

Q228: Match the term and its definition.There are

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents