On January 1,2016,Trueblood,Inc.purchased a piece of machinery for use in operations.The total acquisition cost was $33,000.The machine has an estimated useful life of three years and a residual value of $3,000.Assume that units produced by the machine will total 16,000 during 2016,23,000 during 2017,and 21,000 during 2018.

Required:

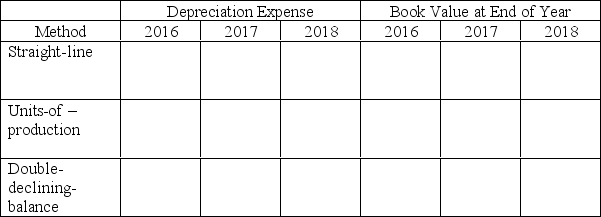

Part a.Use this information to complete the following table.

Part b.On January 1,2017,the machine was rebuilt at a cost of $7,000.After it was rebuilt,the total estimated life of the machine was increased to five years (from the original estimate of three years)and the residual value to $6,000 (from $3,000).Assume that the company chose the straight-line method for depreciation.Compute the annual depreciation expense after the change in estimates.

Part c.Prepare the adjusting entry to record the depreciation expense for the year ended December 31,2017.

Part d.On December 31,2018,the machine was sold for $7,500.Compute the book value on that date.

Part e.Prepare the journal entry to record the sale.

Correct Answer:

Verified

Calculations:

(1) ($33,000 - $...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q247: When estimated useful life of an asset

Q258: During 2016,Ambiance Company reported net revenue of

Q259: Which of the following is the depreciation

Q259: A machine had an estimated useful life

Q260: At the beginning of 2015,your company buys

Q261: Choose the letter of the appropriate category

Q262: Choose the letter to of the appropriate

Q264: Choose the appropriate letter of the explanation

Q265: Choose the letter of the appropriate definition

Q266: On January 1,2016,Morris Minerals paid $300,000 for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents