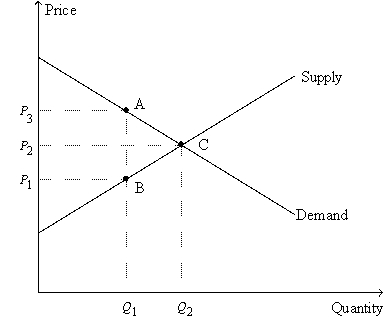

Figure 8-11

-Refer to Figure 8-11.Suppose Q₁ = 4; Q₂ = 7; P₁ = $6; P₂ = $8; and P₃ = $10.Then,when the tax is imposed,

A) the government collects $28 in tax revenue.

B) producer surplus decreases by $13.

C) consumer surplus decreases by $11.

D) the deadweight loss amounts to $9.

Correct Answer:

Verified

Q1: When a good is taxed,the burden of

Q2: The size of the deadweight loss generated

Q9: Sellers of a product will bear the

Q15: Suppose a tax of $1 per unit

Q223: Figure 8-11 Q227: Figure 8-11 Q235: Figure 8-11 Q238: Figure 8-10 Q242: The deadweight loss from a tax of Q245: Figure 8-12 Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

![]()

![]()

![]()

![]()