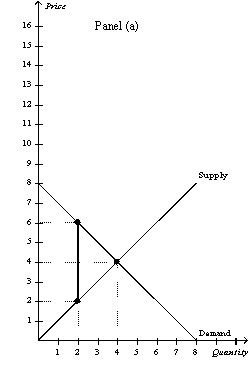

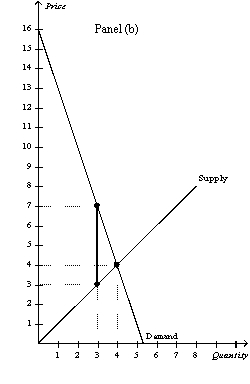

Figure 8-13

-Refer to Figure 8-13.Panel (a) and Panel (b) each illustrate a $4 tax placed on a market.In comparison to Panel (b) ,Panel (a) illustrates which of the following statements?

A) When demand is relatively inelastic, the deadweight loss of a tax is smaller than when demand is relatively elastic.

B) When demand is relatively elastic, the deadweight loss of a tax is larger than when demand is relatively inelastic.

C) When supply is relatively inelastic, the deadweight loss of a tax is smaller than when supply is relatively elastic.

D) When supply is relatively elastic, the deadweight loss of a tax is larger than when supply is relatively inelastic.

Correct Answer:

Verified

Q41: The marginal tax rate on labor income

Q44: Which of the following is not correct?

A)Economists

Q50: Taxes on labor encourage which of the

Q56: Taxes on labor encourage all of the

Q58: Concerning the labor market and taxes on

Q59: The less freedom people are given to

Q200: If the labor supply curve is very

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents