Multiple Choice

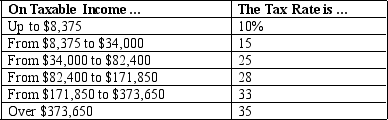

Table 12-1

-Refer to Table 12-1.If Agatha has $80,000 in taxable income,her marginal tax rate is

A) 15%.

B) 25%.

C) 28%.

D) 33%.

Correct Answer:

Verified

Related Questions

Q5: Which of the following is true about

Q14: The largest source of income for the

Q18: In 1789 the percentage of the average

Q23: In 2009,approximately what percentage of federal government