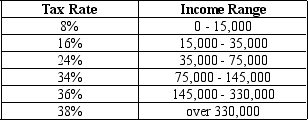

Table 12-2

Consider the tax rates shown in the table below.

-Refer to Table 12-2.If Mateo has taxable income of $165,000,his marginal tax rate is

A) 16%.

B) 24%.

C) 34%.

D) 36%.

Correct Answer:

Verified

Q26: Which type of tax is used to

Q55: Table 12-1 Q58: Table 12-2 Q59: Table 12-2 Q61: Which of the following is not true Q62: In 2009,federal government receipts were approximately Q63: The government's health plan for the elderly Q64: Medicare has been the focus of many Q65: All of the following are transfer payments Q128: Corporate profits distributed as dividends are

![]()

Consider the tax rates shown in

Consider the tax rates shown in

A) $6,800

A)tax-free.

B)taxed once.

C)taxed

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents