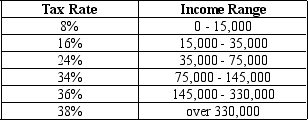

Table 12-2

Consider the tax rates shown in the table below.

-Refer to Table 12-2.If Noah has taxable income of $43,000,his tax liability is

A) $1,920.

B) $4,400.

C) $6,320.

D) $8,175.

Correct Answer:

Verified

Q7: A person's tax liability refers to

A)the percentage

Q12: A family's income tax liability is

A)a standard

Q22: A payroll tax is a tax on

A)the

Q30: A tax on the wages that a

Q40: In 2009,the U.S.federal government collected approximately how

Q41: Table 12-2

Consider the tax rates shown in

Q42: Table 12-2

Consider the tax rates shown in

Q45: Table 12-2

Consider the tax rates shown in

Q46: In 2009,social insurance taxes represented approximately what

Q48: Table 12-2

Consider the tax rates shown in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents