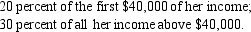

Scenario 12-4. A taxpayer faces the following tax rates on her income:

-Refer to Scenario 12-4.The taxpayer faces

A) a marginal tax rate of 20 percent when her income rises from $40,000 to $40,001.

B) a marginal tax rate of 20 percent when her income rises from $30,000 to $30,001.

C) a marginal tax rate of 0 percent when her income rises from $30,000 to $30,001.

D) a marginal tax rate of 10 percent when her income rises from $40,000 to $40,001.

Correct Answer:

Verified

Q194: If we want to gauge how much

Q195: Suppose the government imposes a tax of

Q362: Individual Retirement Accounts and 401(k) plans make

Q382: Sue earns income of $80,000 per year.

Q386: Tim earns income of $60,000 per year

Q389: Scenario 12-4

A taxpayer faces the following tax

Q390: Nancy paid a tax of $0.50 on

Q392: The deadweight loss of an income tax

Q397: Scenario 12-4

A taxpayer faces the following tax

Q398: A person's tax obligation divided by her

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents