Multiple Choice

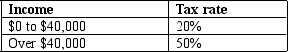

Table 12-5

-Refer to Table 12-5.What is the average tax rate for a person who makes $60,000?

A) 20%

B) 30%

C) 40%

D) 50%

Correct Answer:

Verified

Related Questions

Q203: The marginal tax rate for a lump-sum

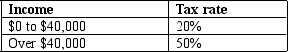

Table 12-5

-Refer to Table 12-5.What is the average tax rate for a person who makes $60,000?

A) 20%

B) 30%

C) 40%

D) 50%

Correct Answer:

Verified

Q203: The marginal tax rate for a lump-sum