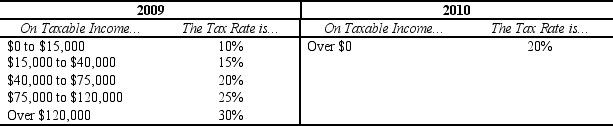

Table 12-10

The following table shows the marginal tax rates for unmarried individuals for two years.

-Refer to Table 12-10.For an individual who earned $80,000 in both years,which of the following statements is true regarding the individual's marginal tax rate?

A) The marginal tax rate is higher in 2010 than in 2009.

B) The marginal tax rate is the same in 2010 as it was in 2009.

C) The marginal tax rate is lower in 2010 than in 2009.

D) With a proportional tax, as in 2010, it is not possible to determine the individual's marginal tax rate so it is not possible to compare the marginal tax rates in the two years.

Correct Answer:

Verified

Q204: The concept that people should pay taxes

Q212: If revenue from a gasoline tax is

Q216: With a lump-sum tax, the

A)marginal tax rate

Q293: Table 12-9

The table below shows the marginal

Q294: Table 12-9

The table below shows the marginal

Q295: Table 12-9

The table below shows the marginal

Q296: Table 12-10

The following table shows the marginal

Q297: Table 12-10

The following table shows the marginal

Q303: Table 12-12

United States Income Tax Rates for

Q498: One advantage of a lump-sum tax over

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents