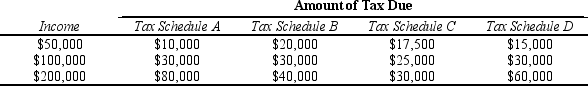

Table 12-11

The following table presents the total tax liability for an unmarried taxpayer under four different tax schedules for the income levels shown.

-Refer to Table 12-11.Which tax schedule could be considered a lump-sum tax?

A) Tax Schedule B only

B) Tax Schedule B and Tax Schedule C

C) Tax Schedule D only

D) None of the tax schedules could be considered a lump-sum tax.

Correct Answer:

Verified

Q81: "A $1,000 tax paid by a poor

Q102: Vertical equity and horizontal equity are associated

Q104: The claim that all citizens should make

Q114: A tax that is higher for men

Q121: If a tax takes a constant fraction

Q136: Which tax system requires all taxpayers to

Q137: An income tax in which the average

Q139: Which of the following statements is correct?

A)Vertical

Q214: If a poor family has three children

Q338: Table 12-13

The dollar amounts in the last

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents