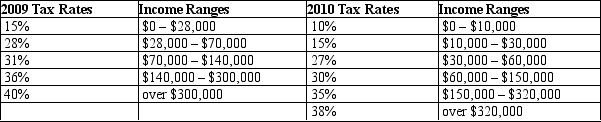

Table 12-12

United States Income Tax Rates for a Single Individual, 2009 and 2010.

-Refer to Table 12-12.What type of tax structure does the United States have in 2010 for single individuals?

A) A proportional tax structure

B) A regressive tax structure

C) A progressive tax structure

D) A lump-sum tax structure

Correct Answer:

Verified

Q89: The benefits principle of taxation can be

Q115: Vertical equity in taxation refers to the

Q116: Vertical equity states that taxpayers with a

Q205: A tax system based on the ability-to-pay

Q208: The argument that each person should pay

Q219: The notion that similar taxpayers should pay

Q321: Table 12-12

United States Income Tax Rates for

Q322: Table 12-10

The following table shows the marginal

Q325: Table 12-10

The following table shows the marginal

Q329: Table 12-11

The following table presents the total

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents