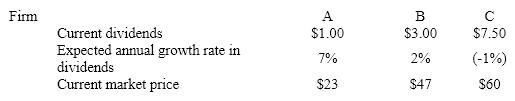

As an investor you have a required rate of return of 14 percent for investments in risky stocks. You have analyzed three risky firms and must decide which (if any)to purchase. Your information is

a. What is your valuation of each stock using the dividend-growth model? Which (if any)should you buy?

b. If you bought Stock A, what is your implied rate of return?

c. If your required rate of return were 10 percent, what should be the price necessary to induce you to buy Stock A?

Correct Answer:

Verified

$1(1+.0...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: If the financial markets were not efficient,

A)all

Q18: According to the efficient market hypothesis, purchasing

Q19: If the anticipated return exceeds the required

Q20: High P/E stocks should be preferred because

Q21: Investors may use P/E and price/sales ratios

Q24: Presently, Stock A pays a dividend of

Q25: Higher required returns

A)decrease stock prices

B)are required by

Q26: The price to sales ratio may be

Q27: You know the following concerning a common

Q28: If the ratio of price to book

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents