Santa Corporation

NOTE : These multiple choice questions require present value information.

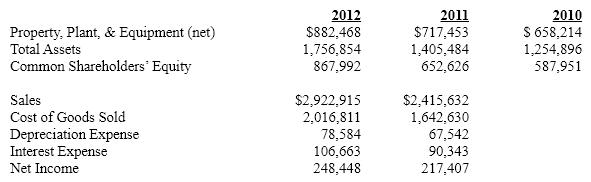

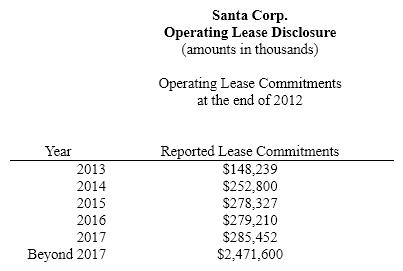

Santa Corporation manufactures Christmas decorations and supplies throughout the world. The company owns property, plants, and equipment and also enters into operating leases for certain facilities. Assume that Santa's incremental borrowing rate is 8%. The company's tax rate is 40%. Listed below are selected financial data for Santa and a portion of the company's operating lease footnote.

A) 8.66 years

B) 13.66 years

C) 10 years

D) Not able to determine

Correct Answer:

Verified

Q21: Santa Corporation

NOTE: These multiple choice questions

Q22: Under current U.S.GAAP,unrealized gains and losses from

Q34: Under the fair value method of accounting

Q35: _ means that a company will buy

Q37: On January 1, 2012, Porter Corporation

Q40: Assuming that Santa Corporation was required to

Q42: The _ is the date a firm

Q43: Discuss the difference between transferring receivables with

Q55: Derivative instruments acquired to hedge exposure to

Q56: One criterion that must be satisfied for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents