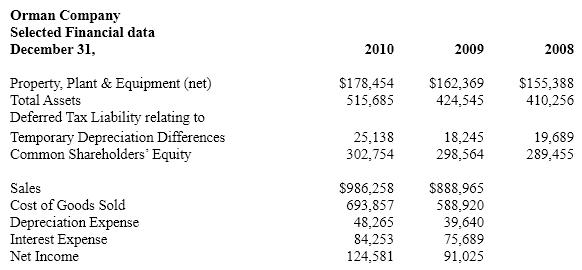

Orman Company is a large international canning company. Orman uses straight-line depreciation for financial reporting purposes and accelerated depreciation for tax reporting. The company's tax rate is 35%. Selected financial information about Orman appears below.

Required:

a. Compute the amount of depreciation expense that Orman recognized for income tax purposes for year 2010 and 2009. The amount reported as the deferred tax liability relating to temporary depreciation differences represents the cumulative income tax delayed as of each balance sheet date because Orman uses accelerated depreciation for tax purposes and straight-line depreciation for financial statement reporting.

b. Compute the fixed asset turnover ratio for years 2010 and 2009 using the amounts reported for financial statement purposes.

c. Compute the fixed asset turnover ratio for years 2010 and 2009 using the amounts reported for tax purposes.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q63: When the functional currency is the U.S.dollar,financial

Q65: When a foreign entity operates as a

Q67: When a company has a minority passive

Q70: Under the equity method the investor's share

Q71: Unrealized holding gains and losses from investments

Q72: Discuss how firms should account for intangible

Q73: When a firm can exercise control or

Q75: An investing firm consolidates the variable interest

Q77: The functional currency of a foreign unit

Q78: Assume that Hsu Company needs to acquire

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents