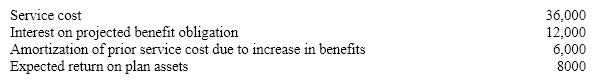

Presented below is pension information related to Roberts Corp. for the year 2012: The amount of pension expense to be reported for 2012 is:

The amount of pension expense to be reported for 2012 is:

A) $46,000

B) $48,000

C) $54,000

D) $40,000

Correct Answer:

Verified

Q1: To calculate a company's average tax rate

Q2: Falcon Networks

Falcon Networks is a leading semiconductor

Q3: Gorilla, Corp. implemented a defined-benefit pension plan

Q5: Falcon Networks

Falcon Networks is a leading

Q6: All of the following are considered by

Q7: The major difference between accounting for pensions

Q9: Which of the following calculations is used

Q10: The accumulated benefit obligation measures:

A) the pension

Q15: All of the following conditions signal that

Q17: Which of the following will most likely

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents