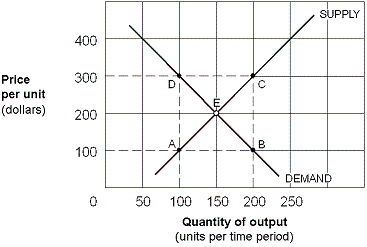

Exhibit 5-9 Supply and Demand Curves for Good X

In Exhibit 5-9, assume the government places a $200 per unit sales tax on Good X. The percentage of the burden of taxation paid by consumers of Good X is:

A) zero.

B) 25 percent.

C) 50 percent.

D) 100 percent.

Correct Answer:

Verified

Q141: Assuming the demand curve is more elastic

Q142: Exhibit 5-9 Supply and Demand Curves for

Q143: In a market with a downward-sloping demand

Q144: If an excise tax is placed on

Q145: To raise the most tax revenue, governments

Q146: Good A has a price elasticity of

Q148: If a government tax has as its

Q149: If the government wants to raise tax

Q150: In the country of Bora Bora, consumers

Q199: If the government wants to raise tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents