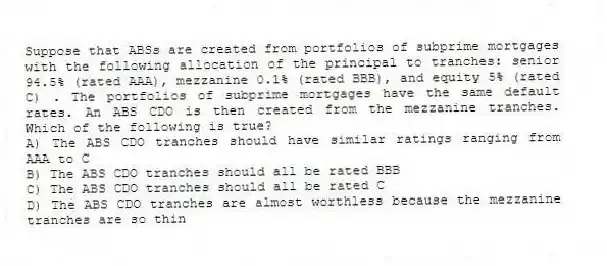

Suppose that ABSs are created from portfolios of subprime mortgages with the following allocation of the principal to tranches: senior 94.5% (rated AAA) , mezzanine 0.1% (rated BBB) , and equity 5% (rated C) . The portfolios of subprime mortgages have the same default rates. An ABS CDO is then created from the mezzanine tranches. Which of the following is true?

A) The ABS CDO tranches should have similar ratings ranging from AAA to C

B) The ABS CDO tranches should all be rated BBB

C) The ABS CDO tranches should all be rated C

D) The ABS CDO tranches are almost worthless because the mezzanine tranches are so thin

Correct Answer:

Verified

Q4: Which of the following tends to lead

Q8: In 2008 the LIBOR-OIS spread reached a

Q8: Suppose that ABSs are created from portfolios

Q9: Which of the following describes a waterfall?

A)

Q10: Which of the following describes a subprime

Q12: Which of the following describes regulatory arbitrage?

A)

Q14: Which of the following were introduced before

Q15: Which of the following is true of

Q15: Which of the following is true as

Q17: Suppose that ABSs are created from portfolios

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents