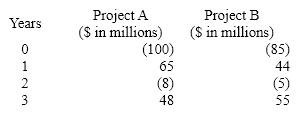

Gamma Inc. is considering two mutually exclusive projects with the following cash flows. Based on their approximate MIRRs, which project should the company accept? Gamma's cost of capital is 8%.

A) Project A, as it has an MIRR of 8%

B) Project B, as it has an MIRR of 5%

C) Project A, as it has an MIRR of 6%

D) Project B, as it has an MIRR of 6%

Correct Answer:

Verified

Q32: The most difficult part of the capital

Q33: Which of the following is the most

Q34: The NPV and IRR techniques can give

Q35: The modified internal rate (MIRR)of return eliminates

Q36: Swift Limited is considering a project with

Q38: Technical problems associated with the internal rate

Q39: A firm's cost of capital is:

A)the time

Q40: The relationship between NPV and IRR is

Q41: Capital rationing requires that companies:

A)always select the

Q42: If a net present value analysis for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents