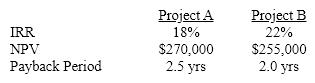

Capital budgeting analysis of mutually exclusive projects A and B yields the following:  Management should choose:

Management should choose:

A) project B because most executives prefer the IRR method.

B) project B because two out of three methods choose it.

C) project A because NPV is the best method

D) Either project because the results aren't consistent.

Correct Answer:

Verified

Q93: Calculate the NPV of a project requiring

Q94: Frazier Fudge, Inc. is considering 2 mutually

Q95: The projected cash flows for two mutually

Q96: A stand-alone capital project has the following

Q97: What is the Equivalent Annual Annuity (EAA)of

Q99: You are considering the following two mutually

Q100: Project A has annual cash flows of

Q101: The payback period:

A)is the time it takes

Q102: In addition to justifying how capital dollars

Q103: The money that a business spends in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents