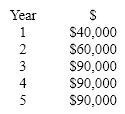

Use the following information for the next four questions. Norlin Corporation is considering an expansion project that will begin next year (Time 0). Norlin's cost of capital is 12%. The initial cost of the project will be $250,000, and it is expected to generate the following cash flows over its five-year life:

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q142: Match the following:

Q143: A difficulty with evaluating mutually exclusive projects

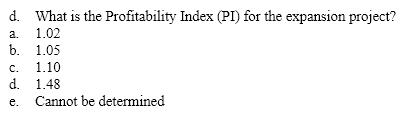

Q144: What is the Profitability Index (PI)for the

Q145: You are considering a project with an

Q146: A firm has a $40 million capital

Q148: What are some of the practical reasons

Q149: When choosing between two mutually exclusive projects

Q150: The profitability index technique is most meaningful

Q151: The equivalent annual annuity method replaces each

Q152: The drawback in the replacement chain method,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents