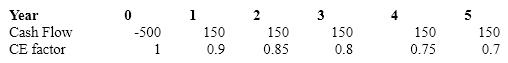

Smith Inc.'s cost of capital is 11% and the risk-free rate is 5%. The company plans to invest in a new project. The cash flow projections ($000) for the project are given below. Calculate the certainty equivalent NPV ($000) .

A) ($51.22)

B) ($54.38)

C) $51.22

D) $22.41

Correct Answer:

Verified

Q52: Which type of project is it most

Q53: In theory, the risk-free rate is more

Q54: A _ is a course of action

Q55: When incorporating risk into capital budgeting through

Q56: Zeta Inc.'s cost of capital is 12%

Q58: Which of the following is the appropriate

Q59: Ignoring _ in capital budgeting can lead

Q60: Which of the following is true of

Q61: A company is a portfolio of projects.

Q62: Risk can be incorporated into capital budgeting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents