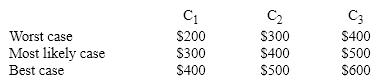

The Basalt Corporation is considering a new venture. Management has made the following cash flow estimates for the project over the next three years under assumptions reflecting best, worst, and most likely scenarios in each year.

Calculate the NPVs of the overall best, most likely, and worst case scenarios and the probability of each.

Calculate the NPVs of the overall best, most likely, and worst case scenarios and the probability of each.

Correct Answer:

Verified

CFo=-1,000, C01=400, C02=500...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q77: Ignoring risk in capital budgeting can lead

Q78: The existence of an abandonment option raises

Q79: Using simulation has few drawbacks since individual

Q80: The value of a real option is

Q81: In theory, the certainty equivalents imply zero

Q83: The appropriate discount rate used in NPV

Q84: Francis Corp is evaluating a capital budgeting

Q85: Certainty equivalent factors can take any numerical

Q86: Using a higher risk adjusted discount rate

Q87: The option to purchase land at a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents