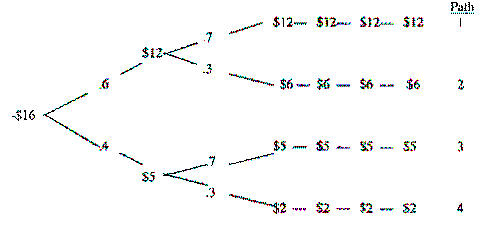

Kanick Corp is evaluating a new venture project and has developed the following decision tree analysis ($M).

Kanick's cost of capital is 12% but a pure play competitor in the new field has been identified with a beta of 1.5. The average stock is returning 14% and treasury bills yield 6%. What is the venture's expected NPV. Discuss its risk characteristics.

Kanick's cost of capital is 12% but a pure play competitor in the new field has been identified with a beta of 1.5. The average stock is returning 14% and treasury bills yield 6%. What is the venture's expected NPV. Discuss its risk characteristics.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q100: The certainty equivalent approach uses computer simulation

Q101: Komarek Forests is considering a new software

Q102: Reading Inc. is contemplating a project represented

Q103: Match the following:

Q104: Scenario and sensitivity analysis are helpful in

Q106: Johnson Inc. estimates the risk-free rate to

Q107: Match the following:

Q108: Match the following:

Q109: The Monte Carlo simulation:

A)Involves making assumptions that

Q110: Riskier projects should be harder to accept

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents