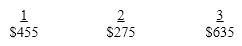

Bumpstead Inc. is interested in acquiring Blondies Corp. which it has estimated will generate the following cash flows over the next three years ($000)  In addition, Bumpstead thinks there will be $25,000 per year in synergies available at no extra cost. Blondies has 50,000 shares outstanding, and its cost of equity is approximately 14%. If Bumpstead is very conservative, and will not look beyond a three year time horizon to justify an acquisition, how much should it pay per share for Blondies stock?

In addition, Bumpstead thinks there will be $25,000 per year in synergies available at no extra cost. Blondies has 50,000 shares outstanding, and its cost of equity is approximately 14%. If Bumpstead is very conservative, and will not look beyond a three year time horizon to justify an acquisition, how much should it pay per share for Blondies stock?

A) $21.95

B) $20.79

C) $23.84

D) None of the above

Correct Answer:

Verified

Q86: Generally, what minimum level of ownership guarantees

Q87: What is the resulting capital structure after

Q88: Target managements that resist mergers usually claim

Q89: If a firm is afraid of being

Q90: The most likely reason for forming a

Q92: A merger may be stopped if a

Q93: TNT, Inc. is considering making a tender

Q94: An acquiring firm can bypass a target's

Q95: _ exists when performance together is better

Q96: Companies A and B combine to form

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents