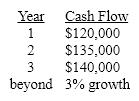

Lavender Inc. is thinking about acquiring Scarlet Corp. After all benefits, synergies and tax effects, Lavender's management has estimated that the incremental cash flows from the acquisition will be as follows

They have also estimated the project's discount rate, appropriately adjusted for risk, at 12%.

They have also estimated the project's discount rate, appropriately adjusted for risk, at 12%.

Scarlet is a privately owned firm with 50,000 shares of stock outstanding. How much should Lavender be willing to pay per share?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q156: Junk bonds became popular in the 1980s

Q157: Merger analysis is always a straightforward exercise

Q158: A spinoff is a last resort effort

Q159: There is virtually no distinction between economic

Q160: Golden parachutes are exorbitant severance packages offered

Q162: Two companies are competitors. The following facts

Q163: Contrast the merger negotiations in a friendly

Q164: Activist investors unlike most individual investors, buy

Q165: Hedge fund investors are typically sophisticated and

Q166: Elliott Mfg. is considering acquiring Fox Inc.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents