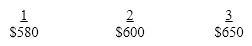

Tancesco Inc. is considering acquiring Aldine Corp. which it has estimated will generate the following after tax cash flows over the next three years ($000). After that management expects a growth rate of 3% indefinitely.

In addition, Tancesco thinks a merger will produce $40,000 per year in after tax synergies. Aldine has 65,000 shares of common stock outstanding. The company's beta is 1.6, the market is currently returning an average of 12% on stock investments and short term treasury bills are yielding 3%. What should Tancesco be willing to pay per share for Aldine if management is willing to value the acquisition over an indefinitely long time horizon?

In addition, Tancesco thinks a merger will produce $40,000 per year in after tax synergies. Aldine has 65,000 shares of common stock outstanding. The company's beta is 1.6, the market is currently returning an average of 12% on stock investments and short term treasury bills are yielding 3%. What should Tancesco be willing to pay per share for Aldine if management is willing to value the acquisition over an indefinitely long time horizon?

Correct Answer:

Verified

Discount rate: kx = kRF + (kM - kRF)bx ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q175: Appleton Inc. wants to acquire Gentronix Corp.,

Q176: Alpha Corp is thinking about acquiring Omega

Q177: It is generally accepted that horizontal mergers

Q178: Match the following:

Q179: Why don't hostile takeovers create feuds between

Q181: In corporations that are said to be

Q182: Activist investors become catalysts for changes aimed

Q183: The biggest criticism of activist investors is

Q184: Activist investors:

A)Seek the support of other stockholder

Q185: Activists maintain that they are different from

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents