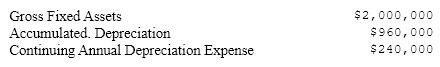

Toys For U, Inc. just purchased a new asset costing $500,000. The machine will be depreciated straight-line over a 10-year period using the convention of taking a half year's depreciation in the first year. Given the following information about old assets the firm already had, calculate net fixed assets at year end.

A) $765,000

B) $925,000

C) $1,275,000

D) $1,600,000

Correct Answer:

Verified

Q71: Assume a municipal bond is issued by

Q72: Grass Enterprises just closed a good year.

Q73: Selected financial statement accounts are as follows.

Q74: The following is a listing of tax

Q75: When must a vendor be paid in

Q77: Depreciation expense of $2,000.00 will cause:

A)Accounts receivable

Q78: Ben bought an ice cream machine 2

Q79: The following tax schedule applies to an

Q80: Retained earnings are:

A)a liability

B)profits that have not

Q81: The double entry system of accounting breaks

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents