The following question(s)refer to the year-end account balances for UBUS, Inc. The accounts are listed in alphabetical order, NOT in the order they appear on the financial statements. The applicable tax rate is 40%.

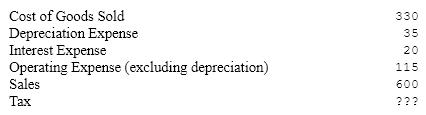

UBUS Income Statement

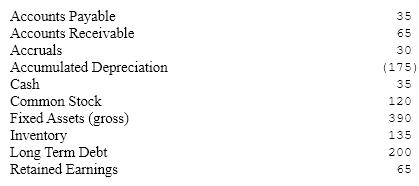

UBUS Balance Sheet

UBUS Balance Sheet

a)What was UBUS Inc.'s earnings before interest and taxes (EBIT)?

a)What was UBUS Inc.'s earnings before interest and taxes (EBIT)?

a. $155

b. $120

c. $100

d. $215

e. $200

b)What is UBUS Inc.'s tax liability?

a. $48

b. $60

c. $55

d. $40

e. $35

c)What was UBUS Inc.'s Net Income?

a. $72

b. $45

c. $60

d. ($20)

e. $100

d)What is UBUS Inc.'s Total Assets?

a. $420

b. $570

c. $625

d. $450

e. $490

e)What is UBUS Inc.'s Total Equity?

a. $115

b. $120

c. $185

d. $205

e. $240

f)What is UBUS Inc.'s Net Working Capital?

a. $35

b. $70

c. $100

d. $130

e. $170

Correct Answer:

Verified

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q131: The tax treatment of capital gains is

Q132: The taxation of proprietorships is about the

Q133: A company has a loss of $15,000

Q134: A family has taxable income of $150,000.

Q135: XYZ Inc. has taxable income of $14,000,000

Q137: A progressive tax system taxes incremental income

Q138: The following is a listing of tax

Q139: In the corporate tax system, higher-income taxpayers

Q140: The government uses the tax system to

Q141: Selected 20x5 financial information for the Taggart

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents