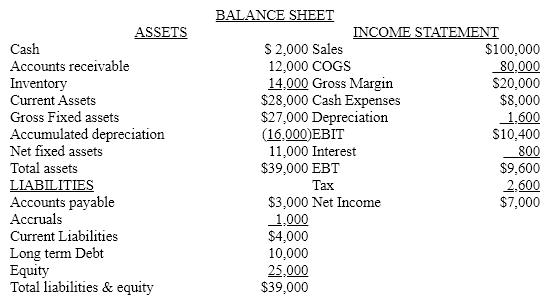

Emperor Corporation's financial statements for the last year are shown below. All figures are in thousands ($000). The firm paid a $1,000 dividend to its stockholders during the year. Two million shares of stock are outstanding. The stock is currently trading at a price of $50. There were no sales of new stock. Lease payments totaling $400 are included in cost and expense.

Develop Emperor's:

Develop Emperor's:

Current Ratio

Quick Ratio

Average Collection Period (ACP)

Inventory Turnover

Fixed Asset Turnover

Total Asset Turnover

Debt Ratio

Debt to Equity ratio

Times Interest Earned (TIE)

Cash Coverage

Fixed Charge Coverage

Return on Sales (ROS)

Return on Assets (ROA)

Return on Equity (ROE)

Price Earnings Ratio (P/E)

Market to Book Value Ratio

Correct Answer:

Verified

Quick Ratio:...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q77: If a firm's current ratio and quick

Q78: In two successive years, it is possible

Q79: Du Pont analysis breaks a firm's ROE

Q80: Ratio analysis is of significant value in

Q81: Match the following:

Q83: It is said that "ratio analysis doesn't

Q84: Match the following:

Q85: Return on Assets (ROA)measures a firm's ability

Q86: Ballantine Inc. has the following financial statements

Q87: Smart Motors' return on sales is 3

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents