Baxter Inc. is in a fast growing industry, but doesn't seem to be able to match its competitors' growth rates. Selected financial information for Baxter is as follows ($000):

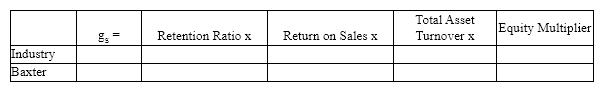

Research has revealed that the average firm in Baxter's industry pays out 10% of its earnings in dividends, earns 4 cents after tax on every sales dollar, has an equity multiplier of 3.0 and a total asset turnover of 1.9.

Research has revealed that the average firm in Baxter's industry pays out 10% of its earnings in dividends, earns 4 cents after tax on every sales dollar, has an equity multiplier of 3.0 and a total asset turnover of 1.9.

a. Use a sustainable growth rate analysis in the following table to determine the source(s)of Baxter's growth problems.

b. What negatives might be associated with fixing the problems revealed by the analysis?

b. What negatives might be associated with fixing the problems revealed by the analysis?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q103: Match the following:

Q104: Match the following:

Q105: Match the following:

Q106: Which of the following is not one

Q107: Match the following:

Q109: Key Graphics expects to finish the current

Q110: Short-term financing is particularly important with respect

Q111: Small businesses usually create a single business

Q112: How have personal computers affected financial planning.

Q113: A firm is planning to lower its

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents