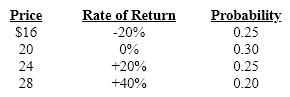

Phoenix Company common stock is currently selling for $20 per share. Security analysts at Smith Blarney have assigned the following probability distribution to the price of (and rate of return on) Phoenix stock one year from now:  Assuming that Phoenix is not expected to pay any dividends during the coming year, determine the expected rate of return on Phoenix Stock.

Assuming that Phoenix is not expected to pay any dividends during the coming year, determine the expected rate of return on Phoenix Stock.

A) 8%

B) 0%

C) 10%

D) 40%

Correct Answer:

Verified

Q66: Don has $3,000 invested in AT&T with

Q86: Sally's broker told her that the expected

Q87: A classic example of a negative beta

Q88: PDQ stock has a required return of

Q89: If you invest 30% of your funds

Q90: According to the SML, the risk premium

Q92: In the CAPM the characteristic line for

Q93: The only component of the CAPM equation

Q95: A portfolio is made up of four

Q96: Assume a portfolio is made up of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents