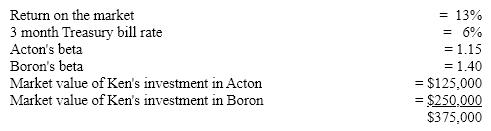

Ken Howard has a two stock portfolio consisting of Acton Inc. and Boron Corp. Assume the following conditions exist.  What does the SML predict is Ken's required rate of return for the overall portfolio?

What does the SML predict is Ken's required rate of return for the overall portfolio?

A) 15.24%

B) 14.93%

C) 23.12%

D) 20.90%

Correct Answer:

Verified

Q70: Elephant Company common stock has a beta

Q103: In general, which of the securities below

Q104: If a firm receives bad news about

Q106: The expected rate of return for 3COM

Q107: Kelvin Inc. has required return of 15%

Q109: If the required return for a stock

Q110: Security A will yield a 6% return

Q111: Assume a portfolio is made up of

Q112: Use the following information to calculate the

Q113: Hatter Enterprise paid a dividend last year

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents