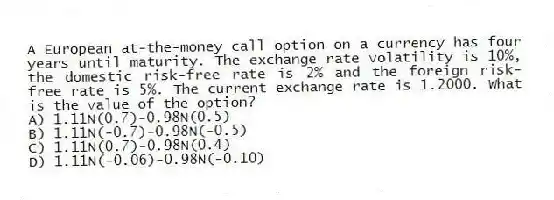

A European at-the-money call option on a currency has four years until maturity. The exchange rate volatility is 10%, the domestic risk-free rate is 2% and the foreign risk-free rate is 5%. The current exchange rate is 1.2000. What is the value of the option?

A) 1.11N(0.7) -0.98N(0.5)

B) 1.11N(-0.7) -0.98N(-0.5)

C) 1.11N(0.7) -0.98N(0.4)

D) 1.11N(-0.06) -0.98N(-0.10)

Correct Answer:

Verified

Q4: Which of the following describes what a

Q5: A binomial tree with three-month time steps

Q9: What is the size of one option

Q10: Index put options are used to provide

Q11: A portfolio manager in charge of a

Q12: What is the same as 100 call

Q13: What should the continuous dividend yield be

Q19: Which of the following is NOT true

Q20: For a European put option on an

Q20: A portfolio manager in charge of a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents