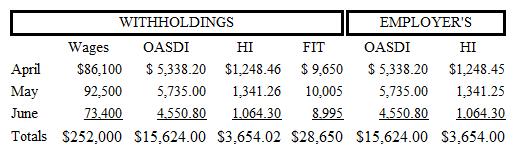

Lidge Company of Texas (TX) is classified as a monthly depositor and pays its employees monthly. The following payroll information is for the second quarter of 20--.

The number of employees on June 12, 20-- was 11.

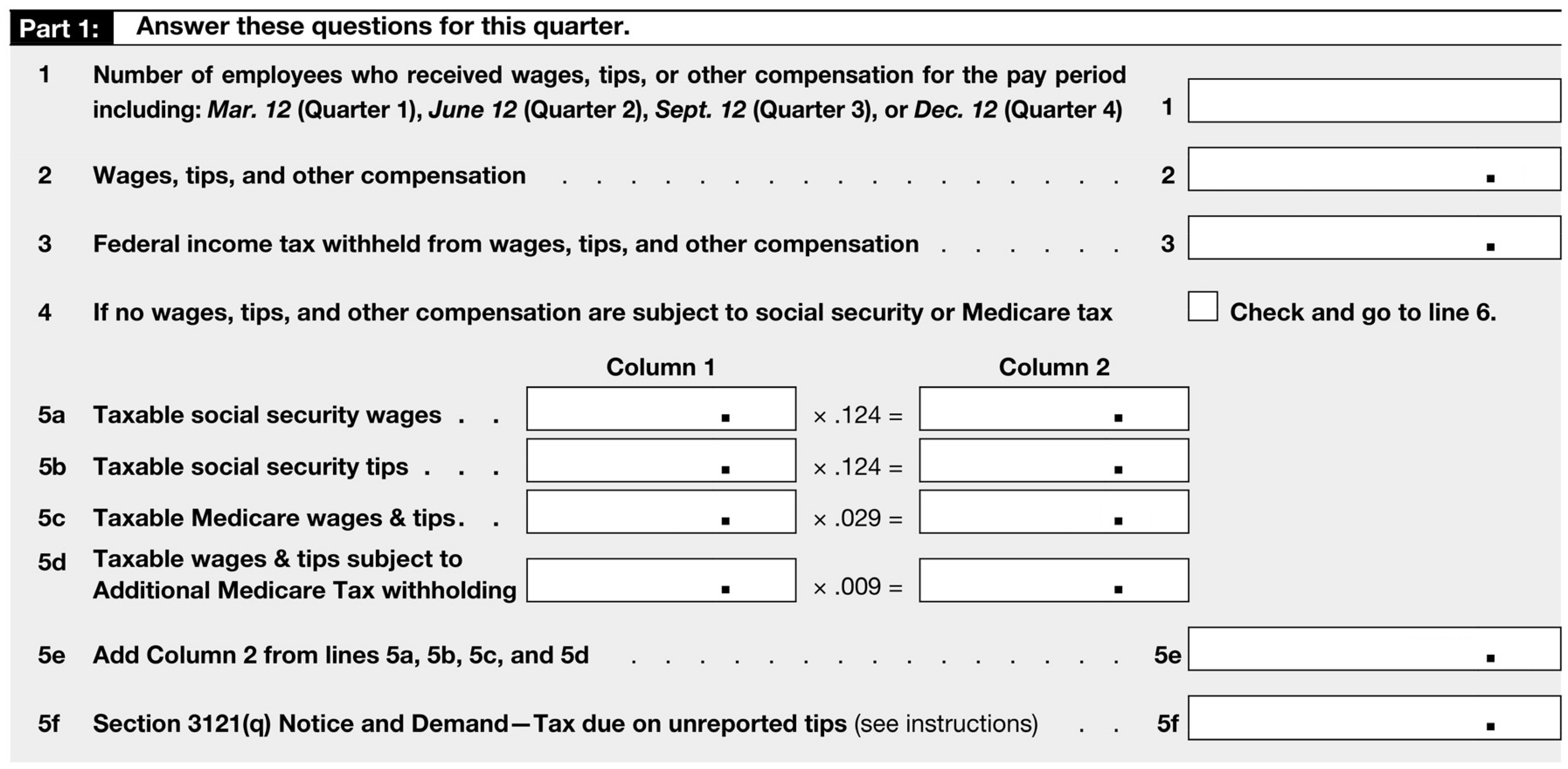

a. Complete the following portion of Form 941.

Source: Internal Revenue Service

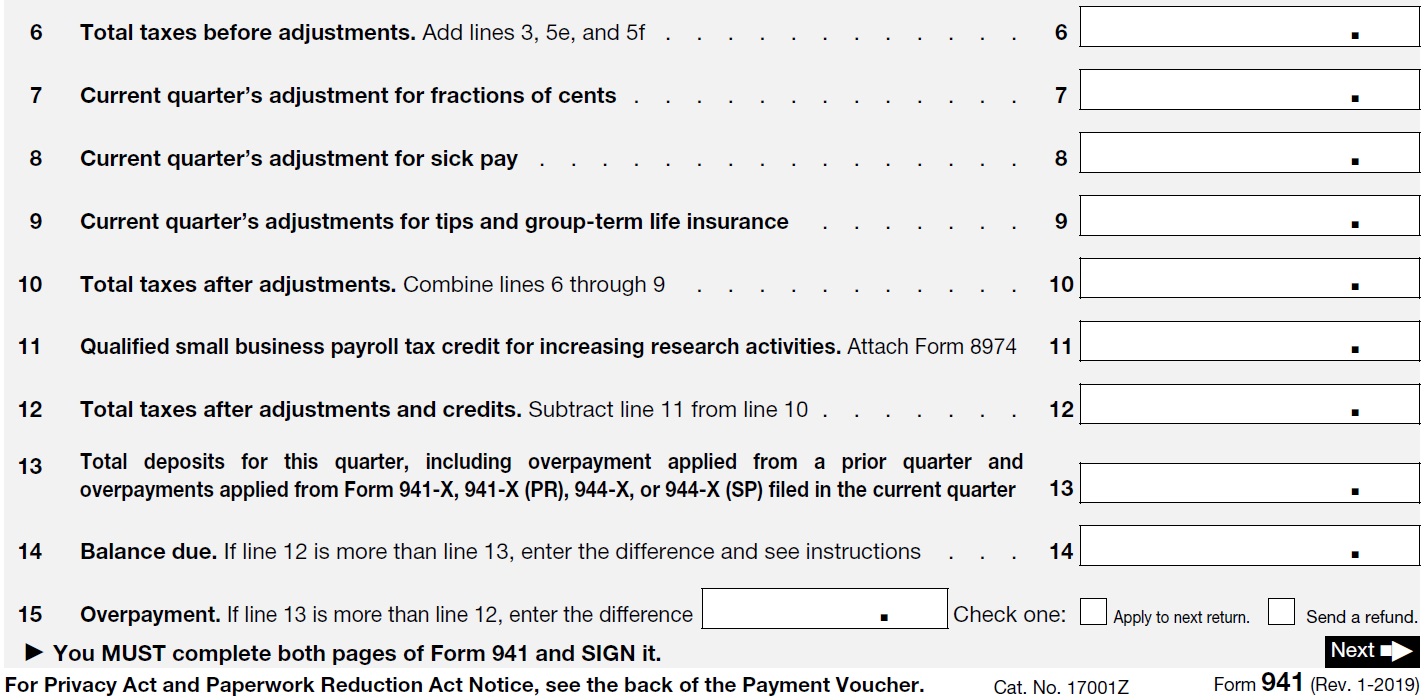

b. Complete the following portion of Form 941.

Source: Internal Revenue Service

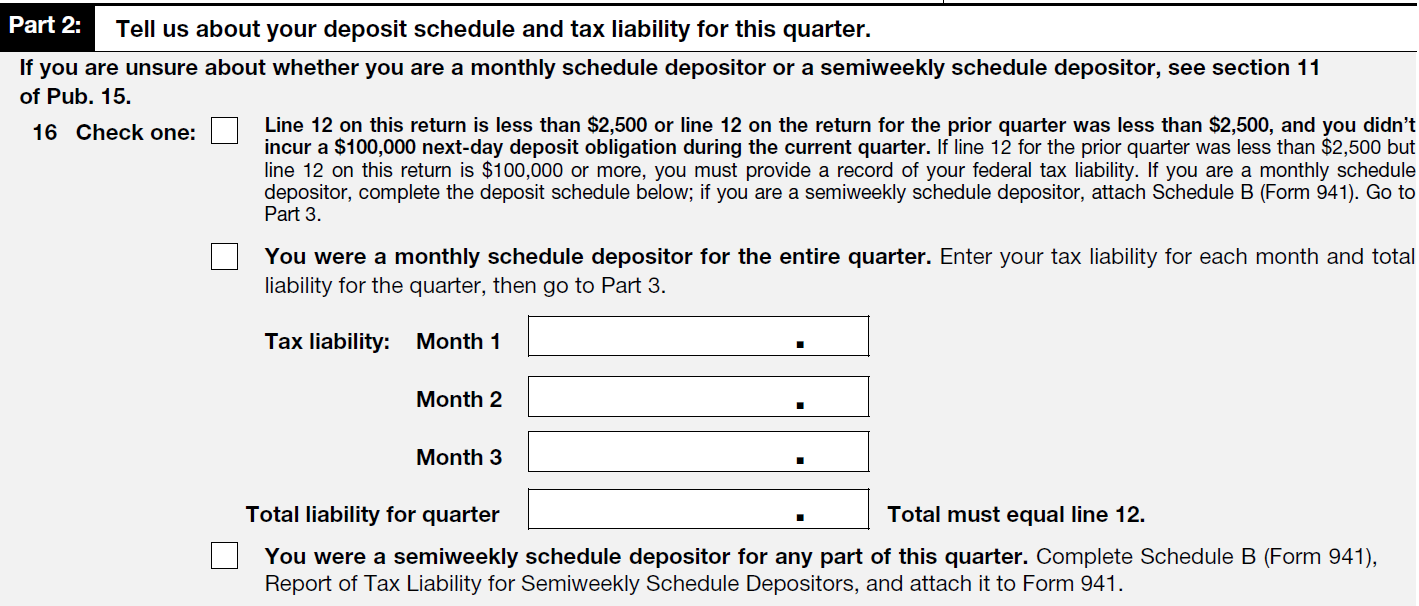

c. Complete Part 2 of Form 941.

Source: Internal Revenue Service

d. What are the payment due dates of each of the monthly liabilities assuming all

deposits were made on time, and the due date of the filing of Form 941 (year 20--)?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q59: FICA defines all of the following as

Q60: Which of the following deposit requirements pertains

Q61: Employees and independent contractors pay different FICA

Q62: Instruction 3-1

Use the following tax rates,

Q63: Instruction 3-1 Q65: If on any day during a deposit Q66: Instruction 3-1 Q67: Instruction 3-1 Q68: Instruction 3-1 Q69: Employer contributions for retirement plan payments for Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

![]()

![]()

![]()