Instruction 3-1

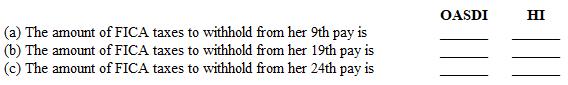

Use the following tax rates and taxable wage bases: Employees' and Employer's OASDI-6.2% both on $132,900; HI-1.45% for employees and employers on the total wages paid. Employees' Supplemental HI of 0.9 percent on wages in excess of $200,000 was not applicable.

Refer to Instruction 3-1. During 20--, Amanda Hines, president of Dunne, Inc., was paid a semimonthly salary of $7,100. Determine the following amounts.

Correct Answer:

Verified

Q81: A monthly depositor's employment taxes total $3,800

Q82: Self-employed persons who also work other jobs

Q83: The requirements for depositing FICA taxes and

Q84: Employers who file Form 941 electronically are

Q85: If the last day for filing Form

Q87: On payday, Friday, a semiweekly depositor has

Q88: If tax deposits are made on time,

Q89: Once the initial Form 941 is filed

Q90: Instruction 3-1

Use the following tax rates

Q91: Instruction 3-1

Use the following tax rates

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents