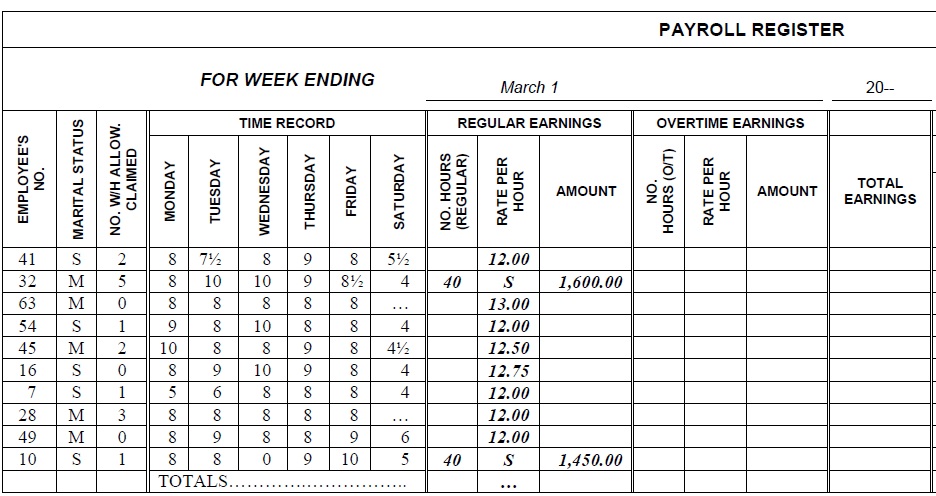

Complete the following payroll register for employees of Corby Company for the week ended March 1, 20--. Taxable earnings should be computed on the basis of a 40-hour week with overtime earnings being paid at time and one-half for all hours over 40 each workweek (no overtime for salaried employees).

Note: Carry each overtime hourly rate out to 3 decimal places and then round off to 2 decimal places.

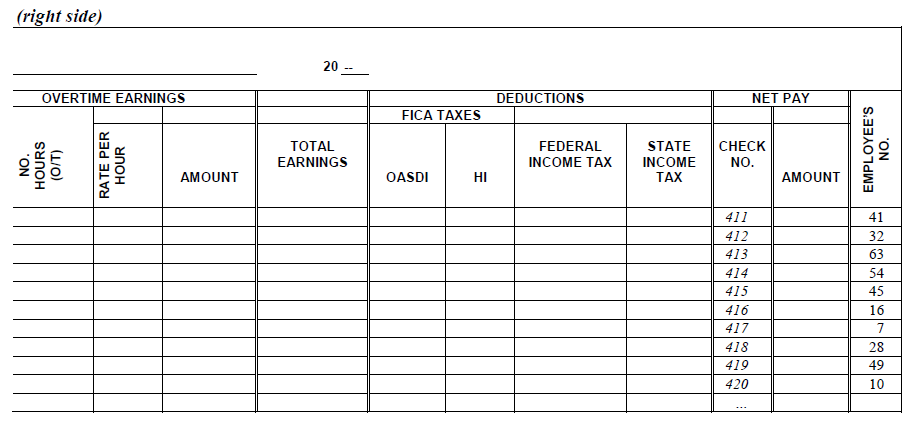

All employees' wages are subject to the OASDI tax of 6.2% and the HI tax of 1.45%. The supplemental HI rate of 0.9% is not applicable.

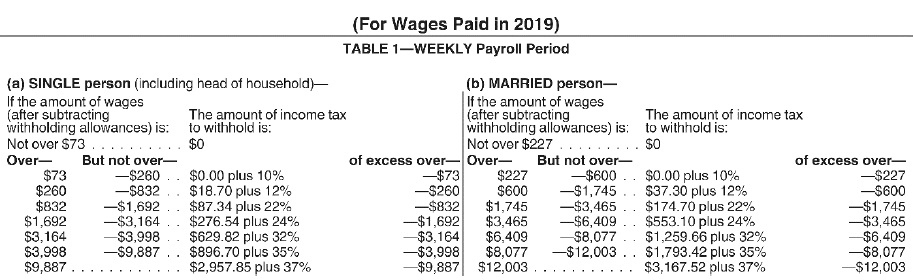

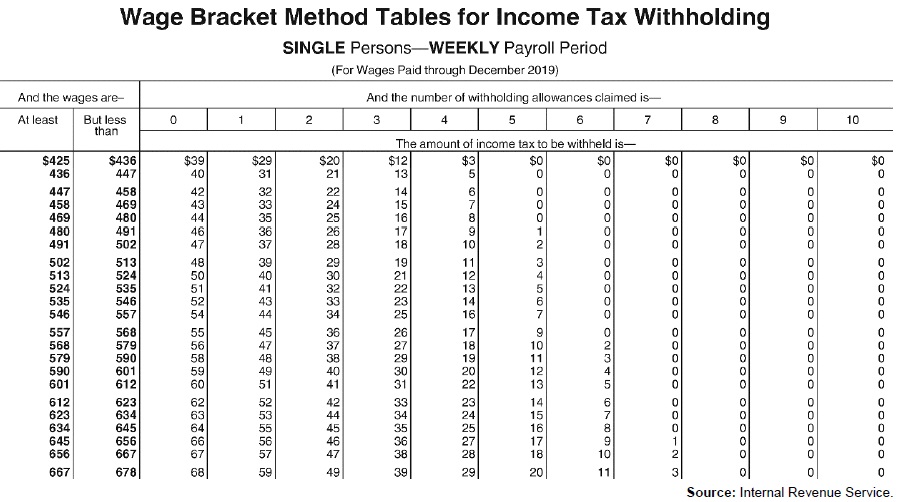

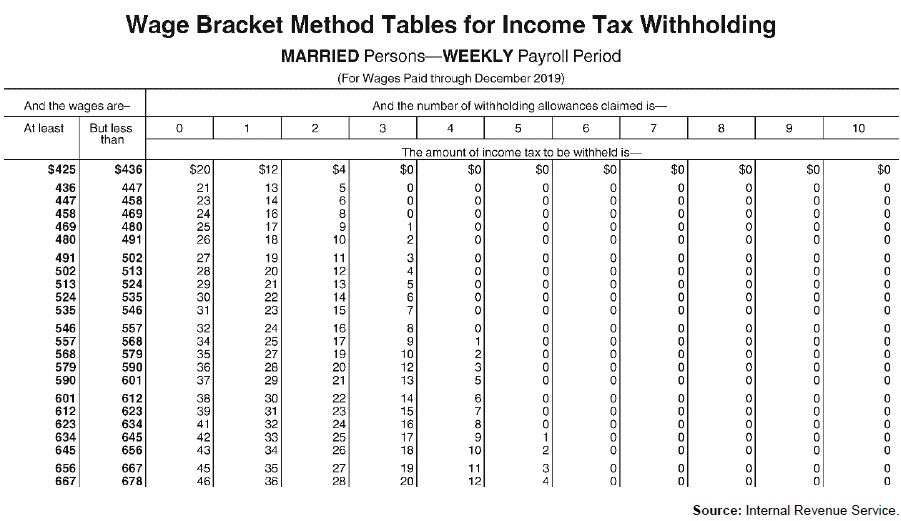

Use the partial wage-bracket tables provided to determine the amount of federal income tax to be withheld. For the salaried employees (#32 and #10), use the percentage method table.

All workers are employed in a state that imposes a 2% income tax on the gross wages earned by each worker.

Amount of One Withholding Allowance Weekly $80.80

Percentage Method Tables for Income Tax Withholding

Source: Internal Revenue Service

Correct Answer:

Verified

( Right-side )

* $1,600 - 5($80.80) ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q78: Employee's payroll deductions into their 401(K) plans

Q79: A worker with three employers should always

Q80: An employee filed a Form W-4 and

Q81: Both the percentage method and the wage-bracket

Q82: Wolf Company is giving a net bonus

Q83: A publisher is preparing information returns to

Q84: Ron Case, married with four dependents, failed

Q85: The withholding on vacation wage payments is

A)

Q87: Which of the following forms is not

Q88: Employers must submit Forms W-4 to the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents