Instruction 5-1

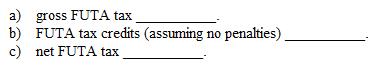

Use the net FUTA tax rate of 0.6% on the first $7,000 of taxable wages.

Refer to Instruction 5-1 . Queno Company had FUTA taxable wages of $510,900 during the year. Determine its:

Correct Answer:

Verified

Q58: Instruction 5-1

Use the net FUTA tax

Q59: If the employer has made timely deposits

Q60: The person who is not an authorized

Q61: The payments of FUTA taxes are included

Q62: The maximum credit that can be applied

Q64: If an employer pays a SUTA tax

Q65: Instruction 5-1

Use the net FUTA tax

Q66: For the purpose of the FUTA tax,

Q67: Instruction 5-1

Use the net FUTA tax

Q68: In the case of an employee who

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents